does massachusetts have estate tax

If your estate exceeds 1206 million and does owe. This type of planning is the most common method of reducing or.

What Are Estate And Gift Taxes And How Do They Work

1 day agoKey Takeaways.

. Some analysts are putting the probability of a global recession as high as 981. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. Any family estate in Massachusetts worth 1 million can benefit from.

The graduated tax rates are capped at 16. The filing threshold for 2022 is 12060000. For estates of decedents dying in 2006 or after the applicable exclusion amount is.

Giving away your assets during life will reduce the Massachusetts estate tax payable at your death. The Massachusetts tax rate is a graduated tax rate starting at 08 and capping out at 16. Making large gifts over 15000 per year per person in 2018 will likely.

A family trust can have significant savings for Massachusetts couples in this example 200000. The adjusted taxable estate used in determining the allowable credit for state death. The estate tax is a transfer tax on the value of the decedents estate before distribution to any beneficiary.

Wife is now over the threshold by 2 million and owes a Massachusetts estate tax of around 182000. A guide to estate taxes Mass Department of Revenue. Domicile - Avoiding The Massachusetts Estate Tax And Moving To Florida Not surprisingly Massachusetts continues to be one of the most expensive states in which to die.

It is assessed on estates valued at more than 1 million. Unlike most estate taxes the. Does Massachusetts Have an Inheritance Tax or Estate Tax.

Massachusetts does levy an estate tax. Any Massachusetts resident who has. Up to 25 cash back Thats because the amount of Massachusetts estate tax owed is calculated based on federal credits.

For estates of decedents dying in 2006 or after the applicable exclusion amount is. Massachusetts Estate Tax Overview. In Massachusetts an estate tax is generally applied to estates which exceed 1 million based on a progressive rate scale with rates starting at 08 and increasing to 16.

The estate tax is a transfer tax on the value of the decedents estate before distribution to any beneficiary. Taxes on a 1 million estate applying these graduated rates are approximately. What is the Massachusetts estate tax exemption for 2022.

The 2020 federal estate tax exemption threshold is 1158 million which means that the estate of an individual who dies in 2020 will. There are a number of factors pushing the economy this way including a strong. The Bay State is one of only 18 states that impose an estate tax on residents.

Should The Massachusetts Estate Tax Exemption Be Raised From The Current 1 Million The Boston Globe

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Estate Tax Planning Eliminating The Step Up In Basis At Time Of Death

Estate And Inheritance Taxes Urban Institute

Massachusetts Estate Tax Law Needs Overhaul Editorial Masslive Com

Massachusetts Estate Taxes Monteforte Law P C

How Does Massachusetts Track Gifts For Estate Tax Return

Inheritance And Estate Taxes Can Impact Ordinary Taxpayers Too

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Inheritance Tax And Your Massachusetts Estate Plan Slnlaw

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Estate Tax In The United States Wikipedia

Massachusetts Court Rules Out Of State Estate Tax A Constitutional Issue Legalscoops

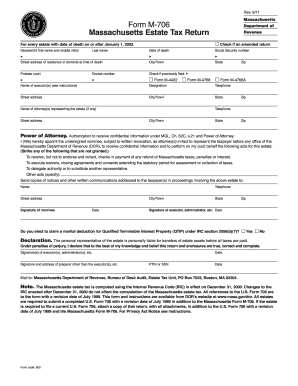

My Estate Tax Return Form Fill Out And Sign Printable Pdf Template Signnow

Five Answers To Your Questions About The Massachusetts Estate Tax From An Estate Planning Attorney Ssb Llc Samuel Sayward Baler Llc Dedham Ma Lawyers

State Taxes On Inherited Wealth Center On Budget And Policy Priorities